USA's Interest Expense Exceeds Its Defense Spending

In a mesmerizing twist of economic destiny, the United States finds itself at a crossroads, perched on the edge of a profound shift in its financial priorities. The predictions from the Council on Foreign Relations suggest that by 2023, the nation may allocate more resources to service its debt through interest payments than it will allot for the defense of its citizens. This impending shift in priorities, a deviation from historical norms, is underscored by the sobering analysis of the Bureau of Economic Analysis.

READ MORE: Dedollarization is Decolonization

Yet, beneath this financial maelstrom lies a critical nuance: when we dissect gross interest payments, representing the unadulterated sum of interest paid without any deductions, we discover that this dramatic realignment in priorities stealthily unfolded back in 2019. The driving force behind this disquieting trend, without a doubt, is the stratospheric surge in federal debt. In the span of just over a decade, federal debt has skyrocketed from $10.6 trillion in 2008 to a staggering $28.8 trillion by 2021, the result of a complex interplay of factors, including tax cuts, escalating expenditures, wartime commitments, economic contractions, global pandemics, and stimulus packages. These elements coalesce to foretell a historic fiscal reckoning.

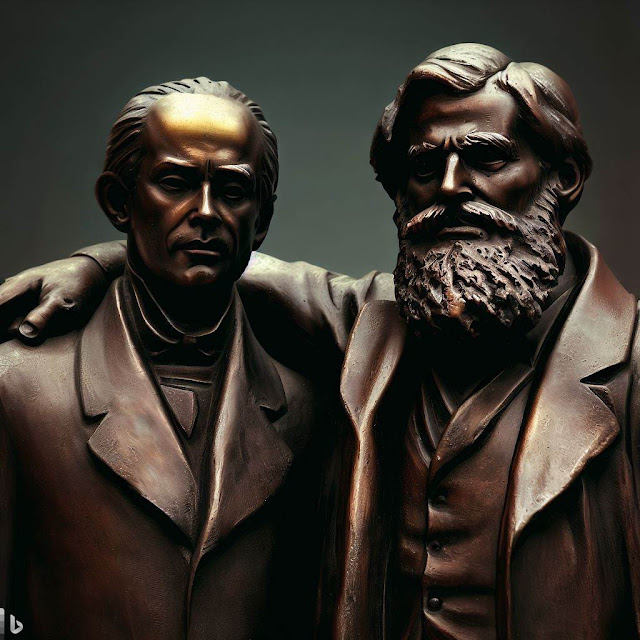

Adam Smith and Karl Marx

Amidst the turbulence of economic theory, the enduring legacy of Adam Smith stands tall. Often hailed as the architect of modern economics, Smith introduced the notion of dividing labor into specialized tasks to enhance productivity, a concept that has become a cornerstone of economic thought. However, as with any profound idea, it bears a multifaceted nature, replete with both advantages and pitfalls. Smith's vision, contrary to misconceptions, was not one of unbridled laissez-faire capitalism. He astutely recognized that specialization could lead to a diminishment of skills among workers and their vulnerability to market vagaries. To counter these pitfalls, he proposed a role for government that encompassed education, trade regulation, and justice enforcement.

In the annals of economic thought, Smith's ideas have been subjected to both praise and criticism, their effects manifesting differently in varying contexts. While designed to spur innovation and competition, they have at times, inadvertently spawned unintended consequences, including:

Worker Exploitation: The division of labor, while boosting efficiency, often exposed workers to exploitation, relegating them to monotonous, low-skilled roles. Acknowledging this issue, Smith proposed a safety net that included public education and the formation of labor unions.

Environmental Degradation: Smith's belief in the "invisible hand" of the market sometimes translated into insufficient government intervention in environmental protection, resulting in resource depletion and ecological degradation.

Social Inequality: Smith's endorsement of free trade often laid domestic producers bare to international competition, amplifying social disparities. His minimalist approach to government intervention did little to alleviate the plight of the impoverished and those adversely affected by market failures.

Misinterpretation: Smith's ideas have, at times, been misappropriated, both by proponents who ignored his moral concerns and by critics who held him culpable for capitalism's imperfections. This duality of interpretation fostered divergent economic philosophies.

Yet, at the core of Smith's philosophy lay the pursuit of wealth distribution through a free market, guided by self-interest and competition. This was intended to yield efficient resource allocation, elevate living standards, and strike a balance among societal strata. To facilitate this, Smith supported the notions of private property and capital accumulation, viewing them as catalysts for innovation.

In contemporary America, however, wealth inequality has reached alarming proportions. Statistics paint a stark picture, revealing that the top 10% of households commandeer a staggering 77% of total household wealth, while the bottom 50% are left to contend with a meager 1%. This concentration of wealth raises pressing concerns about its ramifications for the economy, society, democracy, and human well-being.

Furthermore, skeptics contend that Smith's ideas bore intrinsic flaws, including analytical errors and impractical assumptions. For example, his labor-based theory of value faced criticism for its internal contradictions and limitations. Another facet of the debate revolves around the misinterpretation, rejection, or distortion of Smith's ideas by his intellectual successors, leading to the emergence of distinct economic philosophies.

Karl Marx, an eminent critic of Smith, offered alternative perspectives to address some of these inherent flaws. Marx advocated for collective ownership of resources to eliminate worker exploitation, developed his own theory of value, introduced concepts like surplus value and capital accumulation, and emphasized historical materialism and dialectical logic, with a focus on social forces and class struggle. Yet, amid these differences, it is worth noting that both Smith and Marx acknowledged the limitations of capitalism and shared common values of justice, freedom, equality, and human dignity, albeit approaching them from distinct angles.

In our contemporary era, as the free world grapples with the specter of inflation and a perceptible erosion in the quality of life, it is not unreasonable to suggest that Adam Smith's ideas may have reached a crossroads. Nevertheless, it is crucial to acknowledge that Marxism, too, faced substantial challenges and eventual failure, as exemplified by the demise of the Soviet Union.

Sanatan Economics

In the midst of contemporary upheaval, as the free world grapples with the specter of inflation and a perceptible erosion in the quality of life, a contemplation emerges—an exploration of a potential path forward in the form of "Sanatan Economics." Rooted in the principles of Hinduism, it embodies a holistic approach to economic theory, encompassing:

Dharma: The moral duty or law that guides one's actions and decisions, advocating for ethical economic practices.

Artha: The pursuit of wealth or material prosperity, but in a righteous and ethical manner.

Karma: The law of cause and effect, highlighting the repercussions of one's actions on economic well-being.

Moksha: The ultimate goal of liberation from the cycle of birth and death, analogous to the pursuit of societal harmony and equitable prosperity.

Sanatan Economics presents an alternative framework, one that considers not only the pursuit of wealth but also its ethical underpinnings and broader implications. It invites reflection on the moral imperative of economic actions and their reverberations through the lens of karma, acknowledging that choices in the economic sphere have profound consequences.

In this intricate and ever-evolving economic landscape, the legacy of Adam Smith serves as a potent reminder of the necessity for a nuanced approach to economic policy. Such an approach must consider both the advantages and limitations of market forces and actively address concerns like worker exploitation, environmental sustainability, and wealth inequality, all while embracing the principles of Sanatan Economics to infuse ethics and purpose into economic endeavors. The path forward, it seems, lies in transcending ideological rigidity and embracing the rich tapestry of ideas that offer holistic solutions to the complex challenges of our time.

REFERENCES

https://www.cfr.org/blog/us-interest-vs-defense-spending

https://www.wral.com/story/fact-check-will-interest-on-the-federal-debt-soon-cost-more-than-national-defense/20801566/

https://en.wikipedia.org/wiki/Expenditures_in_the_United_States_federal_budget

https://www.cnn.com/2022/11/01/economy/inflation-fed-debt-military/index.html

https://www.cnn.com/2022/11/01/economy/inflation-fed-debt-military/index.html

https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/the-773-billion-question-inflations-impact-on-defense-spending

https://watson.brown.edu/costsofwar/costs/economic/economy/macroeconomic

https://watson.brown.edu/costsofwar/files/cow/imce/papers/2020/Peltier%202020%20-%20The%20Cost%20of%20Debt-financed%20War.pdf

https://en.wikipedia.org/wiki/Income_inequality_in_the_United_States

https://www.stlouisfed.org/open-vault/2019/august/wealth-inequality-in-america-facts-figures

https://www.stlouisfed.org/institute-for-economic-equity/the-state-of-us-wealth-inequality

Kautilya, Arthashastra